Please read the full list of posting rules found in our site’s Terms of Service. Business ownership is a transformative tool that allows women to build wealth on their own terms. I’m committed to demystifying the financial aspects of running a business, breaking down barriers, and making the path to profitability clear and achievable. If you have a skill that can be offered remotely, freelancing can be a great option. Whether it’s writing, graphic design, web development, or digital marketing, platforms like Upwork and Fiverr can connect you with clients worldwide. Factor in cash equivalents that could be liquidated quickly and other sources of cash to have a plan in place.

Best Free Accounting Software

However, they say that using customizations requires a learning curve, and the price increases at each renewal, rendering the platform unaffordable for many small businesses in time. Suitable software will help you store all of the payroll records that HMRC requires – such as payments to employees and deductions, payments made to HMRC, and taxable expenses and benefits. As a small business owner, you need to balance your accounting records with your bank records. Keeping an eye on your expenses is essential for tax purposes, but also for the general health of your business.

Understand your taxes.

You might be better off investing that money back into your business to support growth and development. These fixed expenses are built into your business budget, and your cash reserves need to be too. You won’t stock your emergency fund in one swoop, but you can make this process more manageable by setting a smaller, monthly goal for yourself.

Should you choose single-entry or double-entry bookkeeping?

- But before that, let’s go over some of the main accounting principles and terminology.

- Some accounting software comes with invoicing features, like automated payment reminders, or you may opt for separate invoicing software.

- From there, I was asked a few questions about my business, such as the types of services I offer and how big my team is.

- Your business may also be required to pay state taxes in both your home state (where your business is registered) and in any states where your business has nexus.

- For example, I could immediately use the search bar across the top of the screen to search my documents by keyword.

To qualify for a business loan, you’ll need to provide a lender with accurate records of your business’s financials. Financial statements, such as a balance sheet, income statement, and cash flow statement may be necessary. If you’re a traditionalist and are more interested in tracking income and expenses than bank connectivity or cloud access, check out GnuCash. Record each transaction (billing customers, receiving cash from customers, paying vendors, etc.) daily or weekly, depending on volume. Although recording transactions manually or in a digital spreadsheet is acceptable, it is probably easier to use a small business accounting software like QuickBooks.

Though you won’t need to disclose evidence on your tax return, HMRC could request to see proof to make sure you’re paying the right tax. That’s not to say your bookkeeper won’t handle tax, or your accountant won’t handle some small business bookkeeping tasks. You’ll need to do elements of both (or have them done for you) if you’re running a small business. Accounting is centred around the presentation and interpretation of that financial data. Accounting tasks involve preparing tax returns, generating reports and forecasts, and auditing.

You’re our first priority.Every time.

Keep in mind that growing businesses generally require more cash on hand, so you’ll want to build those future expenses into your cash reserves. You need to have enough cash set aside in short-term investments, a savings account, or checking account that you can access during a rainy day. But there’s not a one-size-fits-all amount that applies to every business. vendor invoice definition and meaning These questions can help you determine the right amount for your business. Just look at the major impacts the COVID-19 pandemic has had on small businesses across the UK. Studies by the Department for Business, Energy & Industrial Strategy show that almost 400,000 UK businesses closed due to the COVID-19 pandemic, with London and the West Midlands the worst hit.

Many small businesses opt to use cash basis accounting because it’s simple to maintain. The method makes it easy to determine when a transaction has occurred (the money is either in the bank or out of the bank) and there is no need to track receivables or payables. A bookkeeper records business transactions and day-to-day operations. Their job is to manage bills, payroll, invoicing, and transactions with suppliers.

Allow electronic payment systems, which is more convenient and faster in many cases. Finally, structure payroll in billing cycles that flow well with the company’s income stream. This means timing the frequency and amount of payouts in congruence with other business expenses and payouts. If you’re already using expense https://www.online-accounting.net/ tracking software, you can document receipts and invoices in the same platform. This is the act of tracking and reporting income and expenses related to your company’s taxes. You don’t want to be in a situation where you have to pay more income tax than is normally required by the Internal Revenue Service (IRS).

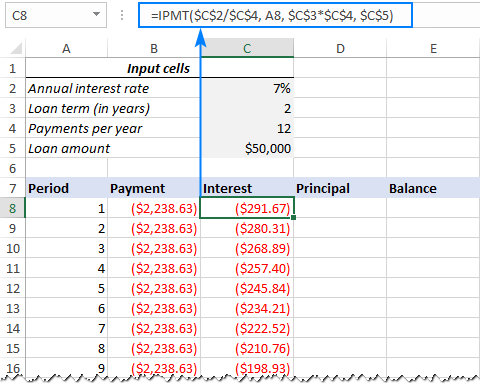

You must use a double-entry accounting system and record two entries for every transaction. When setting up a small business accounting system, you need to choose a method of recording financial transactions. There are basically two methods of recording income and expenses – the cash basis and the accrual basis of accounting. Traditional accounting services focus on transactions (such as recording income and expenses) and compliance (such as preparing financial statements and tax returns). These services are necessary and will continue to be necessary to help SMBOs comply with tax laws and financial reporting requirements. Accounting is the process of keeping track of all financial transactions within a business, such as any money coming in and money going out.

You can convert the quote and bill by a percentage of the original quote or a set quantity, rate or amount. And, you can attach documents to the invoice when needed, including warranties, contracts and return policies. AccountEdge’s invoicing features allow you to send the invoice by email or print an invoice and you can set up recurring transactions after you’ve created your first transaction invoice. Xero earns a 4.4-star rating on Capterra and a 4.3-star rating on G2. They appreciate that the software’s automations create business efficiencies.

These include NCH, Zoho Books, Kashoo, ZipBooks, Sunrise, GnuCash, TrulySmall Invoices and Wave Accounting. Today’s leading accounting platforms offer standard security features such as data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe. To determine the best accounting software, we meticulously evaluated numerous providers across specific categories. Each software was scored based on its performance in these areas, and these scores were calculated to determine the product’s total score, with a potential maximum of five stars.

Sage 50 Accounting, unlike some of its competitors, offers inventory management and job costing features at all plan levels. Also included with every plan is Sage’s own cybersecurity offering, which will keep tabs on your business credit score and monitor for data breaches. Business owners working in construction or manufacturing may be especially drawn to Sage 50’s advanced inventory, job costing, reporting and budgeting capabilities. You should also browse the chart of accounts and make sure it’s organized in a way that makes sense for your business. If you are a small business, chances are you don’t actually need to hire an accountant.

You can skip this step if you’re not planning on hiring any employees. However, even if you’re only hiring an occasional contractor, you should https://www.kelleysbookkeeping.com/prepaid-rent-accounting/ have your payroll system set up. Remember, any time you record a journal entry, there always needs to be a debit and a credit entry.

Reporting capabilities increase with each plan, but even the least expensive Simple Start plan includes more than 50 reports. Small businesses often work with tax advisors to help prepare their tax returns, file them and make sure they’re taking advantage of small-business tax deductions. Though you may not work regularly with a tax specialist year-round, you’ll want to connect with one sooner rather than later so you’re not rushed come tax time. Your reports will look different depending on which you decide to use. When creating an invoice, the software automatically creates the journal entry and maps it to the relevant accounts (accounts receivable, sales, etc.).

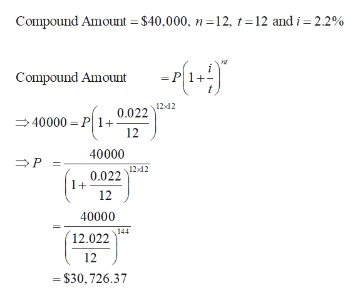

Initially to raise funds, you might rely more on more accessible options like your borrowing from the owner (you), your close circle of people, your family members, your credit cards, etc. When we talk about offline payments, we are referring to payments done with a check, or cash. In this case, the two accounts being affected are the owner’s equity account and the cash account.